Does Entering New Markets Pay Off?

In an increasingly competitive omnichannel market, many regional grocers are charting growth by entering new cities and even new parts of the country. A fresh report from dunnhumby concluded that retailers moving into a different geography may be leaving “millions on the table.”

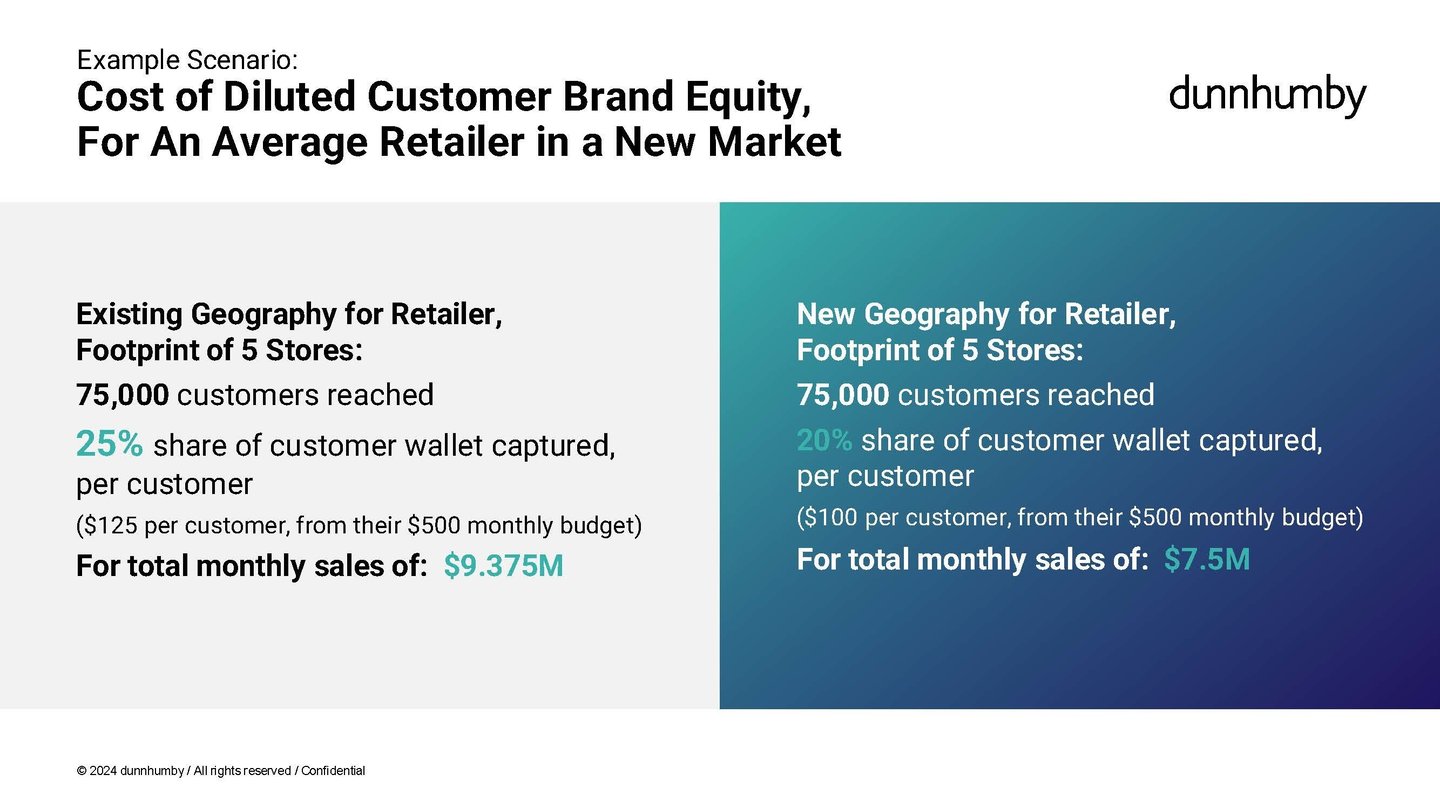

According to the report, "Maximizing Brand Equity in New Markets," the average share of grocery wallet captured from a shopper falls by around 20% for a retailer entering a new market. Accordingly, if a grocer is used to getting a 25% budget share in a particular area, that share in a new market will drop to 20% and likely well into the first few years of operation.

[RELATED: Why the Middle Ground Is Fertile for Grocery Growth]

Such shortfalls are cumulative and impactful. As the report points out, a retailer with 25 locations in a mid-sized city could face opportunity cost as high as $800 million.

The analysts underscored the challenges in another example: “Say you have five stores in a new market that you entered a few years ago, and that you attract 15,000 customers per month/per store, for a total of 75,000 customers in the market. In this example, a 20% reduction in average share of wallet captured translates to $1.875 million in revenue left on the table every month (about $20 million a year). And this, of course, is in a market where you only have five stores. If you have any ambition to grow, the opportunity cost becomes even greater.”

This report took a closer look at specific food retailers who are on the move in new markets. Dunnhumby's researchers used Publix’s recent expansion as a case study, noting that the fast-growing chain has a lower share of wallet in new areas that are immature compared to existing markets.

[RELATED: EXCLUSIVE - Why Location Really Is Everything]

The report stressed that retailers aiming to grow through expansion should follow best practices that include competitive analyses, promotions and other strategies delivering on pricing, assortment and experiences that resonate with local shoppers.

“With a decreasing population base to draw from and an abundance of store types battling it out for customers, retailers need to find more customers to accelerate growth," said Matt O'Grady, president of the Americas for dunnhumby. “For some grocers, one pathway to finding new customers is through building new stores and expanding into new markets. Unfortunately, without careful planning this pathway often results in jeopardizing the bottom line.”