EXCLUSIVE: What the Trade-Off Era Means for Grocers

Is the glass half empty or half full when it comes to grocery shopping habits? New research suggests that retailers and brands may be better served to focus on how to raise the actual volume.

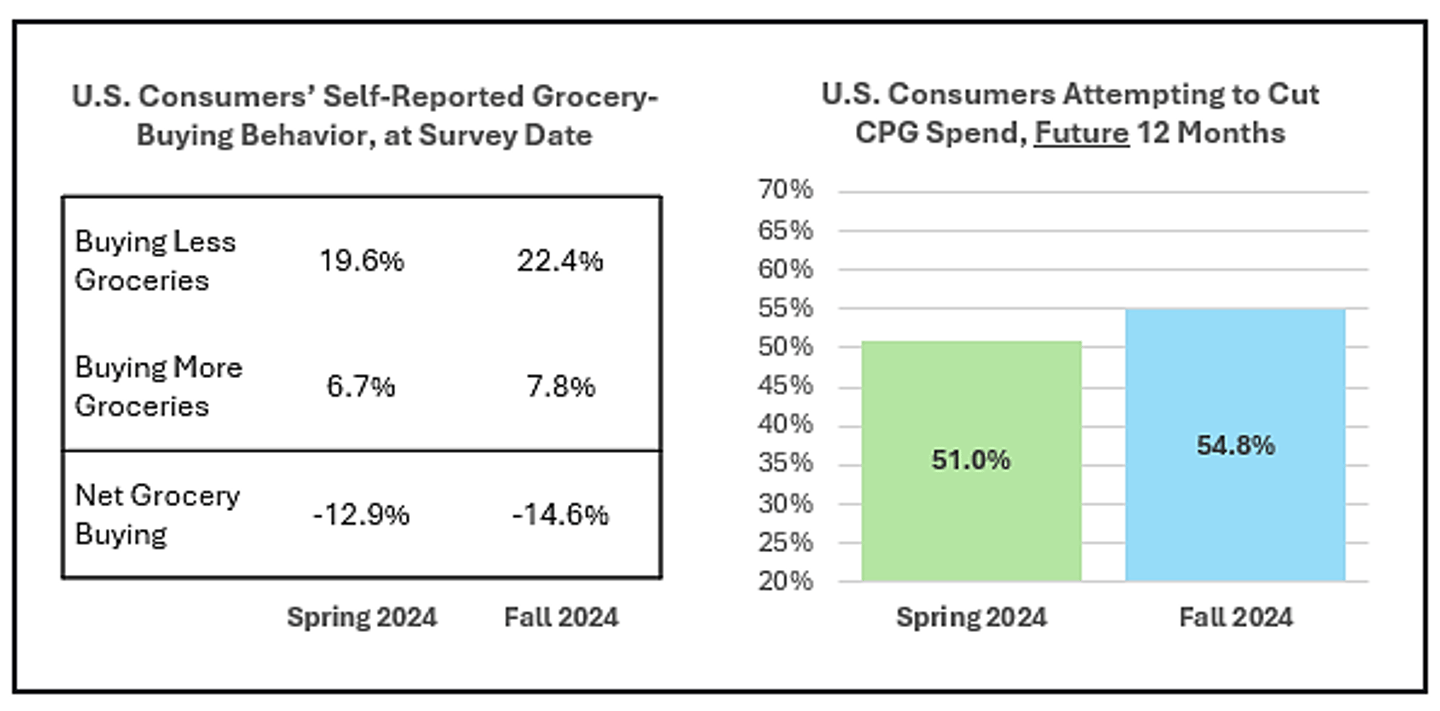

According to a recent report from CPG and retail research firm Big Chalk, consumers remain wary and have pulled back but are still engaging in the retail channel and looking ahead to some relief in 2025. On the cautious side, the firm’s research shows that 54.8% of consumers polled in fall 2024 said they plan to cut their CPG spend over the next year, up from 51% in spring 2024. Also during that time, the percentage of consumers reporting that they are buying fewer groceries edged up to 22.4% from 19.6%.

[RELATED: A Modern Food Industry Must Have a Data Strategy]

“Not surprisingly, consumers have been pessimistic going on three years now. Some of that is a self-fulfilling cycle, to be honest,” Rick Miller, partner in Big Chalk’s marketing effectiveness practice, told Progressive Grocer in an exclusive interview. He noted that the firm tracks sentiment from the consumer behavior side and triangulates that information with public data to determine what consumers intended to do and what they actually did during a particular period.

“The sentiment is trending in the wrong direction, but if you look at what actually happened from June to December, revenue was up by 2% and volumes were a little down,” he continued. “Consumers are paying more and getting less, and it’s been happening for a number of years now. The question is, how long can you keep this up if you are a CPG or retailer?”

The report highlighted some ways that shoppers are adjusting as they remain in a mildly inflationary environment. “In our surveys last spring and fall, people gravitated to lower pack sizes because they cost loss. You might want to buy the gigantic box of cereal, but that box costs $6.50 and the smaller one is $3.99, so you gravitate to that,” Miller pointed out.

The research also shows that consumers continue to engage in trade-off behaviors, actively trying to cut costs in different areas of their lives and toggling between different retail formats. According to Big Chalk, the number of trade-off consumers increased from 27.8% of households to 33.4% of households from June to November 2024. “We serve the CPG industry, but we feel if you really want to understand consumer behavior, you have to know how things like car payments, rent payments and interest payment affect them at the end of the month and how much they have left over to go to the store,” Miller explained.

From a glass-half-full standpoint, Big Chalk’s analysts found some signs of macroeconomic improvement. “We have seen wage growth and we have seen inflation come down a bit, which is why we are somewhat optimistic, although there are a lot of things at play that could upset that,” Miller said.

He pointed to some retailers who have been weathering the ongoing uncertainty. “The bigger winner in all of this – and this is consistent from June to November – is Walmart. We think Walmart has figured out how to reach the trade-off consumer more effectively than others, and we also think that they are pulling in higher income shoppers more than they have in the past, who will spend more in general,” he shared. “ALDI and Lidl are also doing well with the trade-off consumer segment, as are the dollar stores, like Dollar General and Dollar Tree.”

Looking ahead, Big Chalk projects a 1% to 1.5% lift in grocery and CPG revenue in 2025, based on mapping past negative consumer sentiment to real-world CPG sales. The 2025 outlook report concludes that even with easing headwinds, grocers and brands must walk the fine line between right-sized pricing strategies and consumer experiences to maintain market share and growth.