Getting the Most From Micro Fulfillment

A big bright spot — if you can call it that — during the pandemic has been the blazing growth of food retail e-commerce, which is enjoying triple-digit sales growth.

But even as evidence mounts that many grocery shoppers will stick with e-commerce — online ordering, curbside pickup, home deliveries — after the pandemic subsides, food retailers face the stiff challenge of how to keep up with all of that digital growth and activity.

Key Takeaways

- As shoppers’ pandemic-driven e-commerce adoption becomes permanent, food retailers that need to keep up with all of that digital growth and activity will turn to micro fulfillment centers (MFCs).

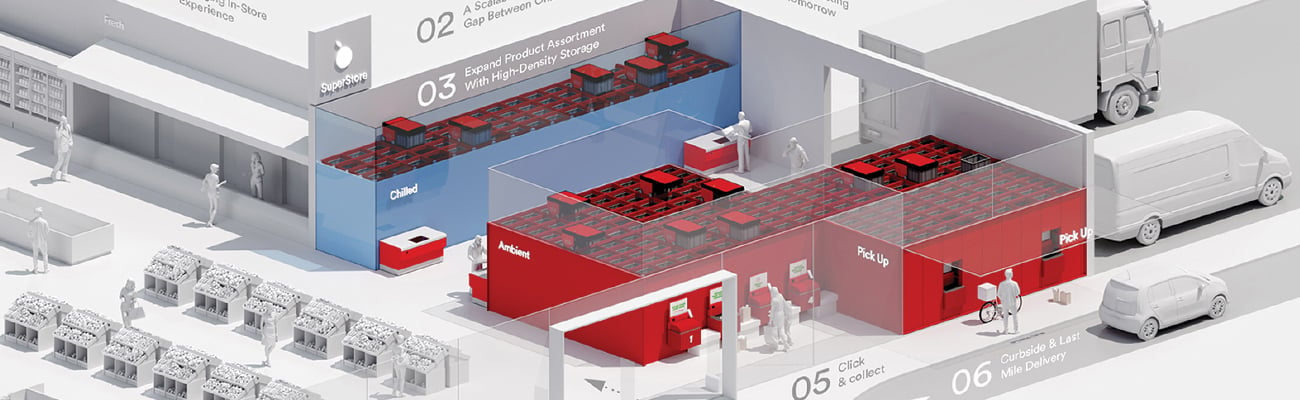

- Grocers can buy MFC systems that make use of empty retail space, or which deploy automated and robotic systems within a grocery store’s existing real estate; a supercenter retail store might support its own center.

- Food retailers face a steep learning curve if they really want to make MFCs a permanent part of their operations.

That helps to explain the quickening rise of micro fulfillment centers, which are designed to act as mini distribution centers that enable grocery workers to efficiently and profitably pick online orders without disrupting other store operations.

“Micro fulfillment is central to our expansion strategy,” says Tim Knoll, COO of Bronx, N.Y.-based FreshDirect.

During the pandemic, the online grocer has seen a 100% growth surge in its suburban footprint and is now working to quickly expand its services while consumer interest in food retail e-commerce reaches all-time highs.

“The combination of the technology with our expertise in automation and fresh food enables us to get closer to our customers quicker and more efficiently with two-hour on-demand delivery of the same great-tasting, quality fresh and prepared food selection mix we offer our customers in New York City,” Knoll adds.

MFC Models

But deploying micro fulfillment center (MFC) systems can be much easier said than done. Still, strategies and best practices centered on micro fulfillment are taking shape quickly, thanks to trends that solidified during the pandemic.

“Most people using curbside pickup will continue using it in some fashion” after the pandemic subsides, says Coleman Roche, VP, sales and consulting retail, e-commerce Americas for Swisslog. Home delivery interest might fade a bit, given the cost of the service, but e-commerce will remain strong in the food retail world. As Roche notes, “The upswing is largely here to stay.”

Indeed, according to U.K. company Interact Analysis, food retailers plan to increase their spending on warehouse automation infrastructure by 20% each year over the next five years. You can bet that much of that money will go toward MFCs, which come in various models.

Food retailers can buy MFC systems that make use of empty retail space, or which deploy automated and robotic systems within a grocery store’s existing real estate. A supercenter retail store might support its own MFC.

Raleigh, N.C.-based Tompkins Robotics, for one, wants to make a splash in this area by selling MFC tech and services designed for smaller, lower-volume stores — an offering that requires no new permits from local officials, explains President Mike Futch, and is portable and can fit into a row of existing pallet racks, with no construction and no expansion costs.

Alert Innovation, another MFC player, sells a service based on a robot called Alphabot, with the Billerica, Mass.-based company promising to automate micro fulfillment center replenishment at less-than-full case levels, dramatically increasing the number of SKUs that each location can support.

Generally, MFCs are ideally meant to serve the e-commerce needs of a neighborhood or another small segment of a particular area, and normally take up no more than 100,000 square feet, according to Mitch Hayes, VP e-commerce and retail for Newport News, Va.-based Swisslog Americas. An MFC is “designed to hold maybe 24-48 hours worth of inventory,” Hayes notes, “and is designed to eliminate the last mile [of delivery]. It’s taking that massive distribution center and localizing the inventory.”

Being clear on what an MFC really is matters, because as new providers see the profit potential and get into the game — among them Tompkins Robotics, which launched its offering in April — food retailers will come under increasing pressure to buy this system or that, and the MFC label might be tacked onto a service or technology that really doesn’t qualify.

One Size Doesn’t Fit All

Growth via Micro Fulfillment

Online grocer FreshDirect keeps growing, and its use of micro fulfillment technology offers a solid view of how the trend is playing out in the food retail space.

Over the summer, FreshDirect revealed that it was enlarging its service footprint in the Washington D.C., metro area, as well as adding on-demand delivery, through a new partnership with New York-based micro fulfillment provider Fabric.

In addition to the D.C. facility, FreshDirect operates two other on-demand micro fulfillment centers — one in Brooklyn, N.Y., and one in Manhattan — that can deliver in as short a time as an hour an order that a customer places on their phone or desktop, according to Tim Knoll, COO of Bronx, N.Y.-based FreshDirect.

“In terms of the micro fulfillment center in Washington, D.C., which will launch in late 2020, about 85% of all products we sell will go through the system,” Knoll says. “The building is refrigerated, so we can store fresh. We made a conscious decision to hold out things that need the human touch — hand-cutting fish and meat, star-rating our produce — all of which we will continue to do manually. We will put more durable items, including fresh, into the system.”

That’s to say nothing of the other variables: How many square feet? What amount of produce, refrigerated items and frozen goods should — and can — the MFC handle? Can the system eventually handle, say, an order from a consumer who prefers green or black bananas rather than yellow ones? How will it deal with the relatively low ceilings of grocery stores, at least compared with distribution centers? How much time will zoning approvals and permitting take? What are the best ways to train workers to use the system?

That’s the thing about MFCs: Not only is the trend new, but also, because of the localized nature of the technology, many food retail locations might have their own unique requirements. “Retailers that have highly repeatable stores, for instance, could actually have installation times of about 12-14 weeks,” says John Lert, who founded Alert Innovation in 2016. Other companies’ products might have longer or shorter deployments — especially as experience accumulates regarding MFC deployments — driving home the point that in this area of retail tech, one size truly does not fit all.

As Steve Hornyak, chief commercial officer of New York-based micro fulfillment provider Fabric, humorously puts it: “You can’t just put Grandpa in skinny jeans.”

Micro Fulfillment ROI

Still, there’s at least one solid thread running through all of this, even as this early stage: the importance of software when it comes to the overall MFC effort.

The cleanliness and speed of data take on added importance for MFC operations, especially as food retailers seek not only to sustain a certain amount of online orders a day to justify the investment, but also to keep adding more perishables to the mix. Software must handle automated picks, manual picks, product returns and various other tasks. Even small failures with software could mess up the process to the point that consumers are receiving wrong items, which could diminish their e-commerce enthusiasm.

Among the main challenges, according to Lert — a challenge that highlights the role of not only having reliable software, but also integrating it into store operations — is making sure that you’re anticipating how e-commerce orders might change over the course of weeks or a month, calculating how to handle that shift in SKUs, and directing efforts accordingly.

In fact, food retailers face a steep learning curve if they really want to make MFCs a permanent part of their operations. “Retailers have a lot to learn about how to shift employees and have them think in different ways,” Lert notes.

So, going into 2021, what’s the return on investment for food retail micro fulfillment? That depends on deployment speed, store size and online order volume, among other factors.

“The typical ROI is two to three years and coming down,” says Hornyak, of Fabric, which worked with FreshDirect on its MFC deployments. “Pretty much everyone who had planned to look at micro fulfillment in 2021, the majority of them are looking at it this year. They’ve basically been told, don’t worry about the budget, [because] they need to figure out the solution.”