Grocery Inflation Flat in February

A lot of eyes were on the Consumer Price Index (CPI) data for February, the first full month of a new Administration and a volatile few weeks with a lot of buzz about tariffs and egg prices. The report from the U.S. Bureau of Labor Statistics (BLS) revealed some of the same trends that have impacted the marketplace in recent times, including ebbs and flows in overall inflation and across various sectors.

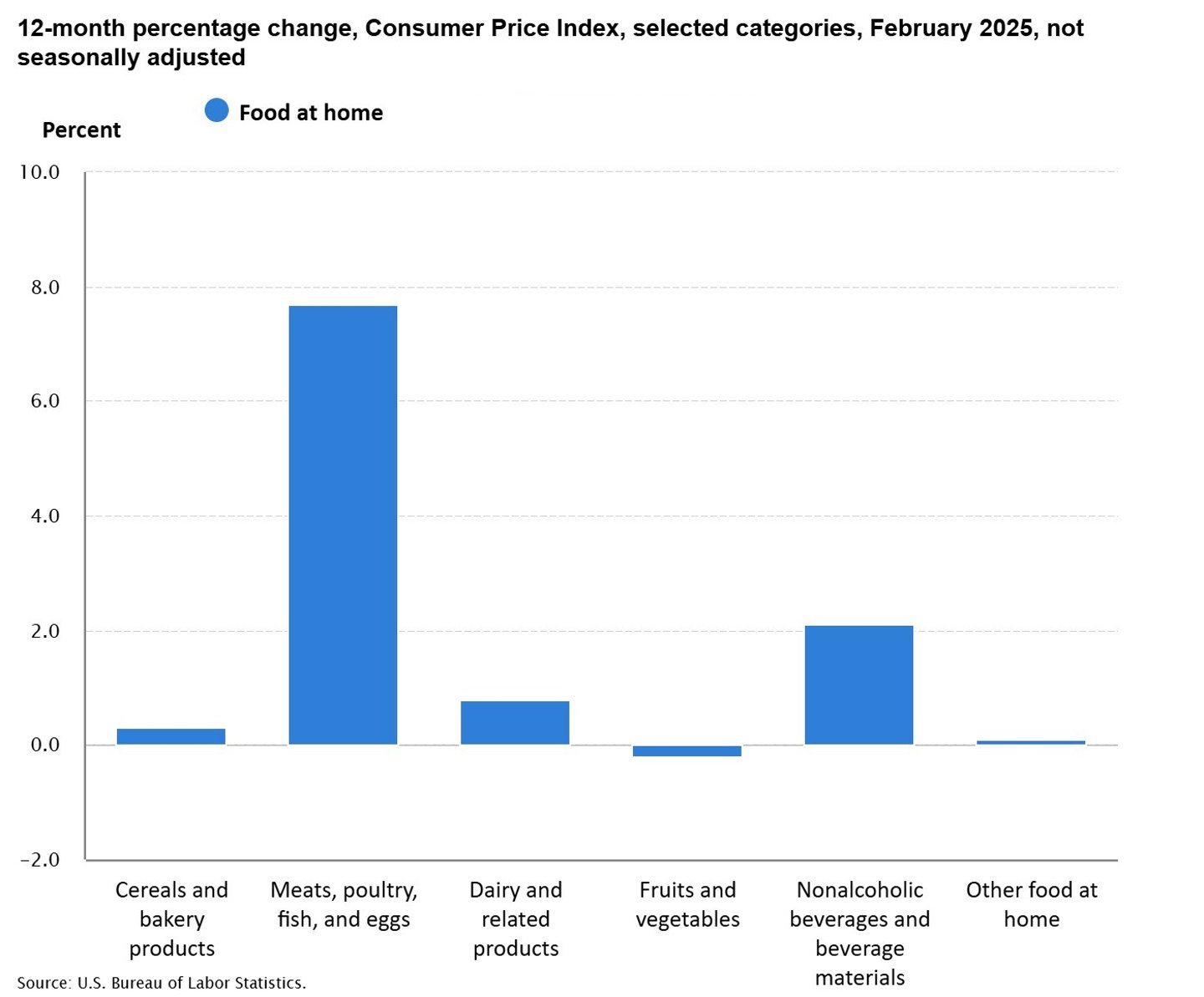

Although the overall CPI for food ticked up 0.2% last month, that’s lower than the 0.5% gain the prior month. The year-over-year (YoY) inflation rate came in at 2.8%, down from previous years' highs.

[RELATED: How Bird Flu and Tariffs Are Affecting Shopper Behaviors]

There was some stability in the grocery sector. The food-at-home index stayed flat from January to February, with price dips in four of the six major group indexes.

Categories with declines include fruits and vegetables, down 0.5% for that period, and dairy and related products, dropping 1%. The index for “other” food at home decreased 0.5%.

That said, protein prices remained elevated. The index for eggs spiked 10.4% in February and the CPI for beef went up 2.4%, fueling a 1.6% hike in the index for meats, poultry, fish and eggs. The cereal and bakery category also experienced mild inflation, rising 0.4% in the second month of 2025.

Beyond grocery, other sectors saw CPI gains. The restaurant industry continues to grapple with increases, as the index for that business climbed 0.4% last month. Meanwhile, the index for shelter rose 0.3% and the energy index moved up 0.2%, despite a decline in gasoline prices.

Data about stabilizing inflation in some sectors comes as overall macroeconomic conditions remain uncertain, given geopolitical difficulties including potential trade wars and ongoing war in Ukraine. That’s why optimism is balanced by caution, according to some experts.

Andy Harig, VP of tax, trade, sustainability and policy development at FMI – The Food Industry Association, weighed on the latest government report. “The CPI data on food-at-home prices released today shows a move in the right direction, even as the broader inflation picture remains complex in the longer term. It is important to note that a significant portion of the monthly increase – albeit smaller from January – was due to the ongoing surge in egg prices, driven in large part by the sustained outbreak of avian influenza,” he remarked. “However, the uncertainty around tariffs poses a challenge to economic conditions moving forward. It remains to be seen what impact they may have on food prices. The food industry will remain flexible and nimble in order to adapt in real-time to best serve customers.”

Added Steve Markenson, FMI’s VP of research and insights: “Grocery shoppers have mixed expectations for the year ahead, and FMI data shows that fears of a looming trade war are taking their toll on consumer sentiment. FMI’s March Grocery Shopper Snapshot found that shoppers expressed a mix of optimism, hope, anxiety and worry. However, while 56% of shoppers surveyed said they had positive expectations for 2025 in the first week of January, that number has fallen to just 45% of shoppers at the start of March. On the bright side, shoppers continue to express a sense of resilience and control, as 77% of shoppers say they feel in control of their household expenditures for groceries.”

Meanwhile, some advocacy groups voiced concern about the fallout of trade and other policies coming from the federal government. The nonprofit Groundwork Collaborative, for example, pointed to potential cuts in food assistance programs and school meal programs and shared a poll indicating that grocery prices are “far and away the top concern for families.”

While the government data paints a complex picture of the inflationary environment, other new research shows how consumers are responding to uncertainty and higher prices for items like eggs. The Bank of America Institute released a report, "Consumer Checkpoint: Will rising food prices eat into spending?," showing that credit and debit card spending per household declined 2.3% YoY in February, compared to a 1.9% YoY rise in January.

The Banks of America Institute report delved into some aspects of grocery shopping behavior in light of pricing trends. “This approach of ‘more but smaller’ shops may allow consumers to focus on buying things they feel represent good value at particular stores. And a natural counterpart is households also shopping increasingly at ‘value’ grocery stores,” the analysts wrote, noting that grocery spending per household at value stores rose 1.2% YoY in February and dropped 1.4% YoY for premium grocers.

The analysts continued, “Overall, if food prices continue to rise, consumers could continue to employ some of these strategies to try and limit the passthrough of higher prices onto their grocery bills, which, in turn, may reduce the risk of them needing to pull back their spending elsewhere. This is particularly relevant for lower-income households, where groceries swallow up a significant share of income.”