Grocery Outlet Still Cycling Pandemic Gains

Grocery Outlet continued to lap last year's pandemic sales gains in the third quarter, posting a 4.3% drop in same-store sales.

For the period ended Oct. 2, Grocery Outlet said net sales increased by 0.6% to $768.9 million. Comps decreased by 4.3% compared to a 9.1% increase in the same period last year. Net income decreased 57.7% to $17.1 million, or 17 cents per diluted share.

"We are pleased with our third quarter financial results and encouraged by our momentum in the fourth quarter," said Eric Lindberg, CEO of Grocery Outlet. "We continue to leverage our highly flexible business model to offer unbeatable value to our customers along with exceptional service from our dedicated independent operators despite the challenging operating environment. Looking forward, we remain excited about our long runway for growth as we continue to expand our store base and test new digital opportunities to broaden our customer reach. We are also pleased to share that our board of directors has authorized a $100 million share repurchase program reflecting confidence in our long-term outlook and our commitment to returning value to shareholders."

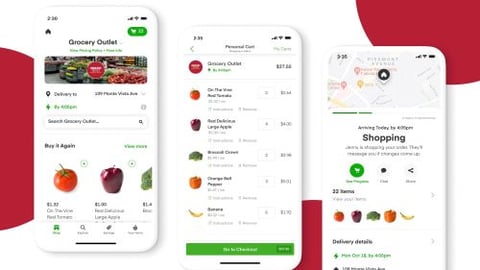

In October, the retailer launched a pilot program at 68 stores in California to test whether the treasure-hunt appeal of its physical stores translates online. The company said it is working with Instacart to launch the program for a six-month period and will offer same-day delivery.

The company opened seven new stores, ending the third quarter with 407 stores in six states. It said it expects to open eight stores during the fourth quarter of fiscal 2021 for a total of 36 new stores opened in fiscal 2021.

Grocery Outlet expects same store sales for the fourth quarter to range between negative 3.5% to negative 2.5%.

The company's board of directors has approved a share repurchase program up to $100 million in shares of common stock. The Share Repurchase Program is effective immediately, does not have an expiration date and is expected to be funded using the company's cash on hand and cash from operations.

Cash and cash equivalents totaled $156.0 million at the end of the third quarter. Total debt was $450.9 million at the end of the third quarter. Net cash provided by operating activities during the third quarter was $56.6 million. Capital expenditures for third quarter, excluding the impact of tenant improvement allowances, were $26.5 million.

"While we remain committed to our capital allocation priority of investing in core organic growth initiatives including continued store expansion, reinvesting in the existing fleet and building the infrastructure to support future growth, this program will allow us to more effectively utilize excess cash and further optimize our capital structure," said Charles Bracher, CFO of Grocery Outlet.

Based in Emeryville, Calif., Grocery Outlet has more than 400 stores in California, Washington, Oregon, Pennsylvania, Idaho and Nevada. The company is No. 69 on The PG 100, Progressive Grocer’s 2021 list of the top food and consumables retailers in North America.