How Did Instacart Fare in Q4, FY24?

Although news reports indicated that Instacart stock had its worst day on record, due to a fourth-quarter revenue miss, the grocery tech company still reported Q4 total revenue of $883 million, a 10% year-over-year (YoY) increase, primarily driven by gross transaction value (GTV) growth.

For the period ended Dec. 31, Instacart’s GTV was $8,645 million, up 10% YoY, reflecting another strong holiday season when orders increased 11% YoY to 77.5 million, partly offset by average order value (AOV), which decreased 1% YoY to $112.

Transaction revenue was $616 million, also up 10% YoY, representing 7.1% of GTV. Transaction revenue as a percent of GTV was flat on a YoY basis as the company reinvested fulfillment efficiencies into affordability initiatives designed to increase customer engagement.

GAAP gross profit in Q4 was $664 million, up 9% YoY, while the GAAP net income of $148 million was up $13 million YoY, representing 1.7% of GTV and 17% of total revenue.

Adjusted EBITDA was $252 million, up 27% YoY, representing 2.9% of GTV and 29% of total revenue.

[RELATED: Supermarkets Lead the Way in Online Grocery Satisfaction - Report]

Full-year 2024 financial highlights for Instacart included GTV of $33,461 million, up 10%, and 294.0 million orders, up 9%.

Total revenue was $3,378 million, up 11% YoY, representing 10.1% of GTV.

Instacart reported transaction revenue of $2,420 million, an 11% increase, representing 7.2% of GTV.

GAAP gross profit came in at $2,542 million, up 12% YoY, representing 7.6% of GTV and 75% of total revenue.

Adjusted EBITDA came in at $885 million, up 38% YoY, representing 2.6% of GTV and 26% of total revenue.

In her Q4 2024 Shareholder Letter, CEO Fidji Simo wrote, “I’m incredibly bullish on our category leadership position, and we remain focused on breaking down the barriers that have kept online grocery from expanding more rapidly to date.”

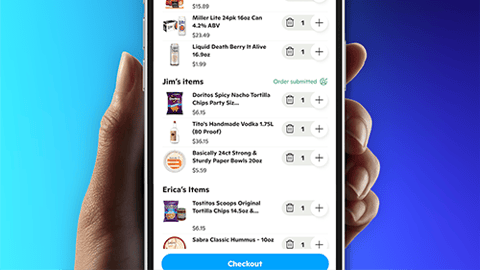

Recently, Instacart lowered its minimum basket size for $0 delivery fees from $35 to $10 for Instacart+ members, making it easier for members to turn to the service when they need just one or two items.

“This is the lowest minimum in the industry, and we’re able to offer this because of our cost-to-serve efficiencies, like often having multiple orders at the same store, at the same time,” wrote Simo. “Early data shows it can help increase order frequency, drive incremental GTV, and further strengthen Instacart+ adoption.”

Instacart also continues to invest in technology. For example, nearly 10% of Instacart orders now come from stores with Carrot Tags software, further improving found rates and shopper efficiency by lighting up electronic shelf labels.

“Soon we’ll begin testing a new solution to source out-of-stock items from another location, which we can do economically because of our dense shopper network,” explained Simo. “In fact, over 50% of our orders are accepted by shoppers who are already at or within a mile of the store. So, when it makes sense, we can have another shopper confirm in real time whether a product is available elsewhere and then complete the customer’s order.”

In her letter, Simo pointed out that Instacart has become an ally for retailers. “Because we partner with over 1,800 retail banners on our marketplace and power the enterprise storefronts for approximately 600 retail banners, we can invest and innovate more than retailers could on their own. We can also make integration more seamless than other technology providers. This played out in 2024 as we launched over 30 net-new retailer sites, compared to less than half that the year before. We also upgraded dozens of retailers to our latest Storefront Pro technology, giving them access to more features, customizations and tools, which has helped the majority of these retailers increase sales by double-digit percentage points or more compared to before the upgrade.”

Additionally, Instacart is seeing strong adoption of Carrot Ads, which helps retailers like Thrive Market build a retail media network on their own properties.

Maplebear Inc. is the registered corporate name of San Francisco-based Instacart.