How Did Retailers Perform in January?

January is typically a more muted month in retail sales, given that it follows the busy holiday season extending from Thanksgiving to New Year’s Eve. New data shows that shoppers pulled back a little in January but continued to eat at home often and shop in ways that meet their lifestyles and budgets.

According to the National Retail Federation (NRF), retailers in general posted year-over-year (YoY) gains in January even as shoppers spent less compared to a busy December. “We’re seeing a ‘choiceful’ and value-conscious consumer who is rotating spending across goods and services and essentials and non-essentials, boosting some sectors while causing challenges in others,” observed NRF President and CEO Matthew Shay.

In the grocery and beverage store sector, sales were down a slight 0.23% month over month on a seasonally adjusted basis. From a YoY standpoint, grocery sales rose 5.5%, unadjusted. General merchandise stores posted a 2.43% dip in January and a 7.53% YoY gain.

[RELATED: Exclusive - What the Trade-Off Era Means for Grocers]

More detailed information on the grocery sector's performance in January will be shared by the U.S. Census Bureau on Feb. 14, when the agency releases its monthly retail and foodservice trade report.

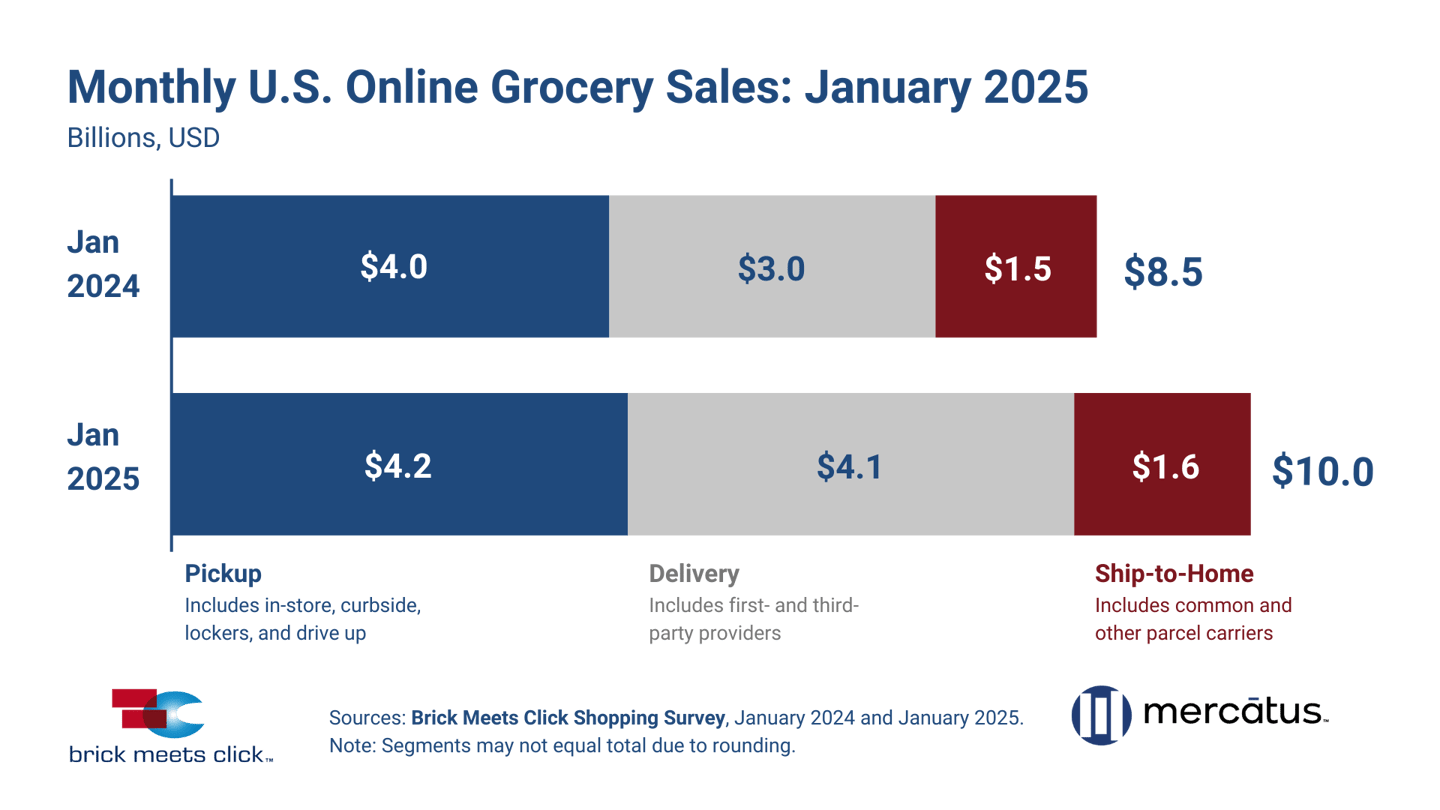

Meanwhile, shoppers were clicking away last month, helping lift the U.S. online grocery market to a 16.6% YoY increase, per the latest Brick Meets Click/Mercatus grocery shopper survey. All three fulfillment methods experienced YoY increases for a monthly e-grocery total of $10.0 billion in sales.

Analysts at Brick Meets Click and Mercatus attributed the uptick in part to broad and deep discounts on membership and subscription programs and a concerted push by some major retailers. “It’s important to call out that much of delivery’s explosive growth is driven by mass and specifically Walmart,” said David Bishop, partner at Brick Meets Click, referencing the 37% surge in delivery sales. “The ongoing waves of promotional tactics are having the intended positive impact on frequency and spend, and they are also increasing retention and share of wallet, which will make growth for their rivals more challenging going forward.”

While growth wasn’t as pronounced as delivery, the pickup method experienced a 4% YoY increase that was fueled by higher average order values. Ship-to-home sales climbed 9% in January compared to January 2024.

The report also highlighted the ongoing tight competition among grocery operators and their rivals in the mass channel. According to the Brick Meets Click/Mercatus data, the mass format has consistently served about half of all monthly active users during each January since 2022, while supermarkets have served a third of monthly active users. On the positive side for the industry, grocery closed one gap with mass in January, as grocers repeat intent rose 600 basis points on a yearly basis and the rate for mass was unchanged.

“Delivery’s impressive growth has been driven by membership promotions, but shoppers can easily shift platforms depending on which factor matters most to them – price, product, or convenience,” said Mark Fairhurst, chief growth marketing officer at Mercatus. “Grocers that prioritize seamless experiences, deliver personalized offers, provide exceptional service, and implement compelling loyalty strategies will be best positioned for sustainable, long-term growth.”