Next-Generation Considerations: Data Visibility, Labor Force, Store Layouts

The art of grocery shopping is in the midst of an evolution, and retailers that recognize that they must update their supply chains accordingly will help ensure a brighter future.

While there are a number of challenges to consider, supply chain experts cite three specific areas that retailers can home in on now to make way for tomorrow: data visibility, as it relates to both retailers and consumers; the need for a new kind of labor force; and revamped store layouts that offer more inspiration while also allowing for more space to fulfill online orders.

“The challenge for retailers today is to recognize that the people who are in their 20s now grocery shopping are more different than ever before, and we need to adapt to that,” says Mike Griswold, research VP for the consumer value chain team at Gartner Inc., a global research and advisory firm based in Stamford, Conn. “If you rewind the clock 30 years ago, there was no online, and kids would go into the store with their parents. That’s how they learned to shop. Fast-forward to today, and the demographic group that’s growing up now, in many instances, has never been in a supermarket.”

Moving forward, some shoppers will prefer to order groceries online, while others will continue to seek out a store experience – so grocers are in a place where they must consider how to provide both options, Griswold notes. Supply chains must be nimble and accurate, which is quite different from how people have traditionally thought of the grocery business.

Visibility and the Importance of Accurate Data

To ensure a more accurate supply chain that can get the right product to the right place at the right time, data visibility will be paramount for the industry. Track-and-trace technology such as blockchain continues to gain attention for all of its potential to provide better visibility, but first, retailers and suppliers must prioritize having clean, accurate data, according to Angela Fernandez, VP of community engagement for GS1 US, based in Ewing, N.J.

Fernandez observes that the industry still needs to strive for higher rates of on-shelf availability and product availability online. Meanwhile, the data being used for digital listings seen by consumers is too often inaccurate. She points to an analysis that GS1 US conducted a year and a half ago with the Trading Partner Alliance (TPA), an industry affairs group formed by the Food Marketing Institute and the Grocery Manufacturers Association, which found a less-than-desirable 55 percent accuracy of product data available digitally. Thankfully, industry leaders are making strides to solve this problem, in reaction to the data inaccuracies found online.

A new initiative being launched by GS1 in collaboration with the Consumer Goods Forum is Verified by GS1, a global registry designed to ensure that product data is accurate, complete and trustworthy.

“Every GS1 office will work with brands and retailers to upload all their product data into a global registry for validation,” explains Fernandez. “This is a massive undertaking, considering there are GS1 offices in 114 countries. We have eight of the largest GS1 offices, including GS1 US, launching [the registry] this year, and then we’ll look at additional rollouts across all the other countries GS1 supports. We’re doing this because a good consumer experience relies on trustworthy data.

On the business side of data visibility, particularly as it relates to traceability, GS1 US has been working on providing implementation guidance for critical tracking events and key data elements, continues Fernandez.

“The romaine lettuce outbreaks we saw last year really put an increased focus on this,” she notes. “The other thing moving this along is the industry’s interest in blockchain, which many organizations, including Walmart, are leading the charge to more fully explore the traceability use case. Standards provide interoperability between brand and retailer systems, help ensure data quality, and are foundational to blockchain applications.”

GS1 US is also providing a new online interactive tool to help suppliers and wholesaler/distributors understand what supply chain data they need to capture, and in what format it should be captured, in the event of a foodborne illness outbreak, she says.

Gartner’s Griswold notes that while master data management certainly “isn’t sexy,” companies that skip the process of collecting the right data and properly analyzing it won’t be able to go further with blockchain or other exciting technologies that provide so much promise for the retail supply chain.

Labor Force of the Future

Meanwhile, as technologies with artificial intelligence and machine learning continue to gain acceptance in retailers’ supply chains, companies will need new talent to help analyze data and understand its impact at retail, advises Griswold.

“You need people to understand how machine learning and artificial intelligence work, how to interpret results, and how to build models, or at least the data that goes into these models,” he says. “The type of talent that retailers need moving forward, particularly around the supply chain, is changing. And the challenge is that everyone is looking for the same talent.”

He recommends investing in a data scientist now, even if you’re not exactly sure how this skill will fit into the organization. Griswold also points to retailers such as Kroger, Walmart and Dollar General, which have been spending more time on college campuses to promote retail supply chain and career opportunities.

“Kroger and Walmart have invested in labs and people, and they’re doing a lot of their own research and development, trying to understand through the vastness of the customer data that they have what customers want and how to deliver against that,” he notes.

Rethinking Store Layouts

At the end of the retail supply chain is the physical store or warehouse, where products are being stored and ultimately taken out to be presented to customers. Even that area is changing, thanks largely to the growth of omnichannel retailing.

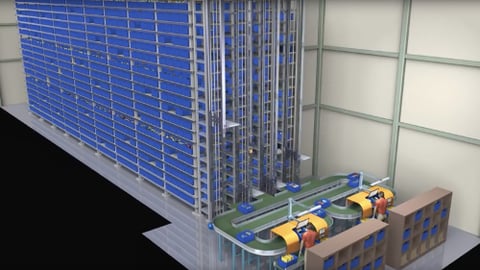

Store layouts need to change to reflect two important needs, in Griswold’s view. First, even standard-size stores that reach up to 70,000 square feet likely need to have a new back-room configuration to allow for mini warehouses that can be used to fulfill online orders.

“It is much more efficient to pick orders out of a back room,” he says. “You don’t have customers there, and you can set it up much more efficiently in terms of the picking cycle.”

Secondly, even though more people are buying groceries online, there are still shoppers who want to visit the store to smell, taste and feel product, so retailers need to make sure they’re providing a sensory, interactive experience, according to Griswold.

“In grocery, the store needs to be about experience – and those experiences should be in fresh food,” he observes. “If people just want a shopping transaction, they can get it online from Amazon.”

For consumers who prefer to shop online, grocers should strive to provide a good buy-online, collect-in-store experience, achieving one- and two-hour delivery or pickup windows, and being able to ship product where customers want to pick it up, he advises. “The ability of the supply chain to do those things that maybe we thought were fads are now becoming things that you have to do,” Griswold asserts. “That’s what’s going to separate companies over the next two to three years.”

- Delving Into Data

While the big chain stores often get more press about their supply chain innovation, several regional grocery retailers have been taking a closer look at supply chain data to solve common challenges in the industry:

- Lakeland, Fla.-based Publix Super Markets has taken a lead on seafood sustainability by participating in the Sustainable Fisheries Partnership’s (SFP) Ocean Disclosure Project, which promotes supply chain transparency. The retailer works with SFP to collect and analyze data that helps it give customers “the very best sustainably sourced seafood,” according to Guy Pizzuti, category manager of seafood at Publix. The data also helps the company identify fisheries with room for improvement.

- Pittsburgh-based Giant Eagle participated in a Trading Partner Alliance pilot with Coca-Cola and Land O’Lakes to better understand and reduce dwell times. Advisors at McKinsey and Co. and Four Kites were also involved in the project. The companies evaluated data from select warehouses on a weekly basis for six months, and met to come up with new ideas and solutions. They considered factors such as physical attributes in the yard, technology for drivers and warehouse staff, manpower use and shift alignment, and scheduled loads. One of the major takeaways from the pilot was that they could create 2 percent to 4 percent additional capacity by improving the dwell time within their control.