Organic Garage Sees Q1 Sales Decline, But Is Still in Strong Position

For its first-quarter financial results ended April 30, Canadian independent grocer Organic Garage reported working capital CAN $1.4 million from working capital of $1.0 million at Jan. 31, and a working capital deficit of CAN $0.3 million as of April 30, 2020, and a cash balance of $2.8 million from $1.6 million as of Jan. 31, and $1.2 million in the year-ago period. Meanwhile, the retailer’s sales declined 12.1% to CAN $7.0 million from $8.0 million, and gross profit dollars fell 16.6% to CAN $2.0 million from CAN $2.4 million.

The company saw a net loss of CAN $907,013 for the quarter ended April 30, compared with a net income of $189,403 for the year-ago period. Organic Garage attributed the decrease primarily to lower sales, non-recurring professional fees related to the retailer’s acquisition of the plant-based Future of Cheese business, OTC application and DTC eligibility, bank charges and merchant fees, stock-based compensation, and non-cash and non-recurring acquisition finder’s fees, offset by decreases in administrative wages and benefits and lower operating expenses related to the company’s phase-out of warehouse operations.

Organic Garage completed its move to a decentralized distribution model in April 2021, and entered into an agreement to sublease the facility at 50 Akron Road for the rest of the lease term. During the three months ended April 30, the company’s incremental savings were about $208,000, consisting primarily of savings related to wages and benefits, transportation, rent and other costs.

“Our Q1 results marked another strong quarter for the company,” said Matt Lurie, CEO of Toronto-based Organic Garage. “We incurred some non-recurring and non-cash expenses during the quarter, which affected our net loss, but we are confident these will have positive long-term impacts on the company’s future. We continue to see strong results from three of our four locations and have focused on incremental renovations to address the lagging performance of one store location.”

Added Lurie: “We are very pleased to start seeing significant incremental savings as a result of moving to a decentralized distribution model and phasing out our warehouse. Our working capital and cash position continue to strengthen, aligning for continued success and allowing the company to continue to focus on delivering value for our shareholders.”

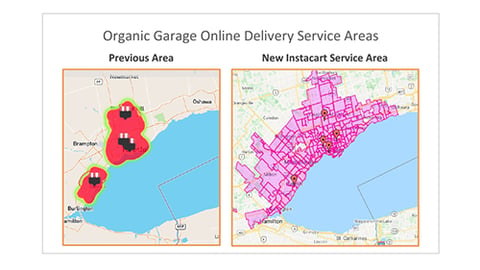

Additionally, the company recently generated an additional $59,400 of cash through the exercise of warrants, expanded its Hand-Picked Partners lineup to include Cheese Boutique, and entered into an exclusive partnership agreement with San Francisco-based Instacart to significantly expand its online delivery range.

“Operations related to the Future of Cheese are progressing at a rapid pace, and we are very excited about the upcoming launch of its products,” said Lurie. “The senior management team is focused on product development, building strategic relationships, strengthening our team, growth of the brand and, most importantly, taking the product to market in the near future.”

As for the Instacart partnership, “we are delighted that our products will be available to service new markets, and we look forward to building on what has already been a great success for our online delivery model,” he observed.

Earlier in the month, Organic Garage reported record results for its fiscal year ending Jan. 31. The retailer notched a 25.3% increase in sales to reach the CAN $30.3 million mark, and increased its gross profit to CAN $8.9 million from CAN $6.7 million.

Organic Garage operates four stores in the greater Toronto area, with plans to expand in the region.