Prices Fuel Higher Grocery Sales in January

A couple of days after the government shared its latest Consumer Price Index (CPI) showing a hotter-than-hoped-for 0.5% monthly increase in grocery inflation, another federal agency released the latest sales data.

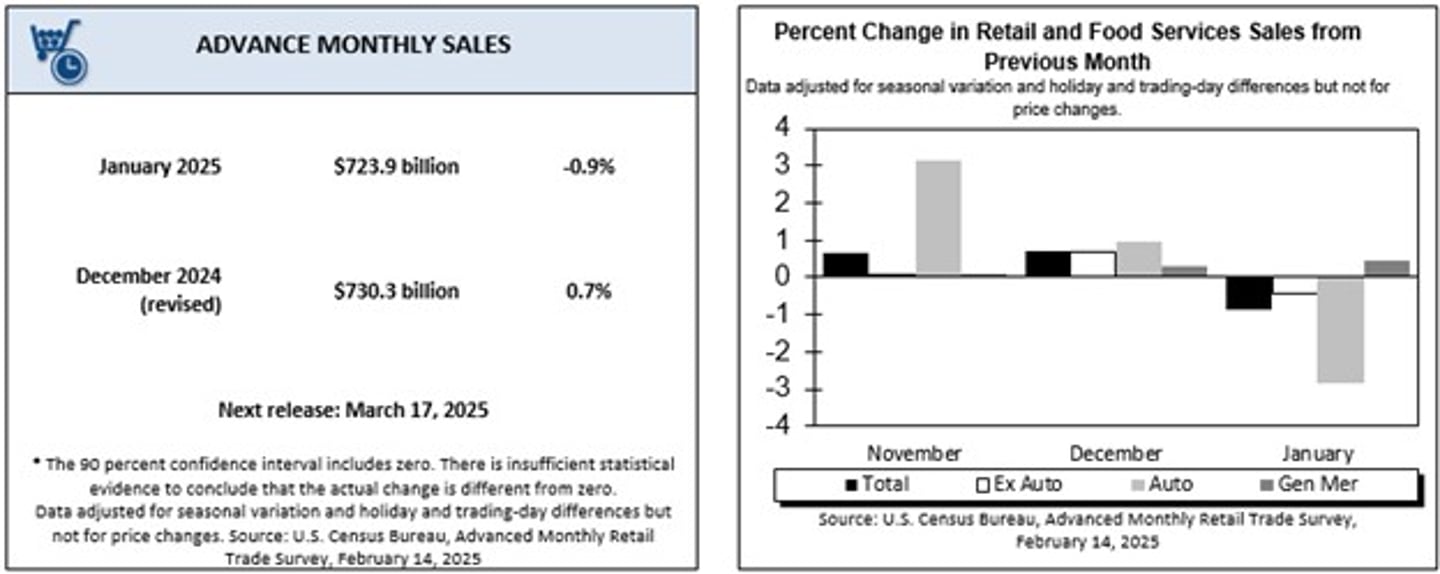

According to the U.S. Census Bureau’s monthly sales report for retail and foodservices, overall sales dipped 0.9% to $723.9 billion from December to January, not unexpectedly due to the post-holiday timing. That said, the grocery sector was stable even after a busy December: adjusted grocery sales edged up 0.2%, topping $76.17 billion in January versus $76.03 billion the prior month. On a year-over-year (YoY) basis, grocery sales came in 3.9% higher.

The bump in sales reflects both resilience among U.S. shoppers and a parallel uptick in inflation. It’s a familiar scenario, following similar trends over the past couple of years.

“The grocery sector saw a slight increase in overall sales compared to December due to the increase in food prices in January. Prices have certainly been impacted by the soaring price of eggs related to elongated issues with avian bird flu,” observed Chip West, a retail and consumer behavior expert with RRD. “This was conveyed as the biggest increase in egg prices in nearly 10 years and has been a primary factor in the rise of food-at-home costs. As a key ingredient in countless products, the rising price of eggs creates a ripple effect that influences broader consumer spending patterns."

Addressing the entire retail and foodservice industries, West noted that sales results in January reflect consumers’ ongoing caution. “After a strong holiday season, retail spending pulled back in January as expected. However, the decline was sharper than forecasted, marking the largest monthly drop in a year,” he observed, citing key factors. “After a holiday season of splurging and credit use, consumers tightened spending in January amid frigid temperatures and extreme weather events, including California wildfires. A drop in automotive sales likely added to the overall decline.”

As for what’s next, West said that this state of shopper behavior may stick around. “Although the scope, specifics, and impact of any proposed tariffs are unknown, there is a perception among consumers that prices will remain high, at least in the short term. Regardless of any actual impact on prices, determined shoppers are likely to continue seeking value. Years of inflation and rising costs have sharpened their savings strategies,” he declared. “I am confident that retailers that maintain strong promotions will be best positioned to outpace their competitors.”