Walmart's Online Grocery Sales Hit Record High

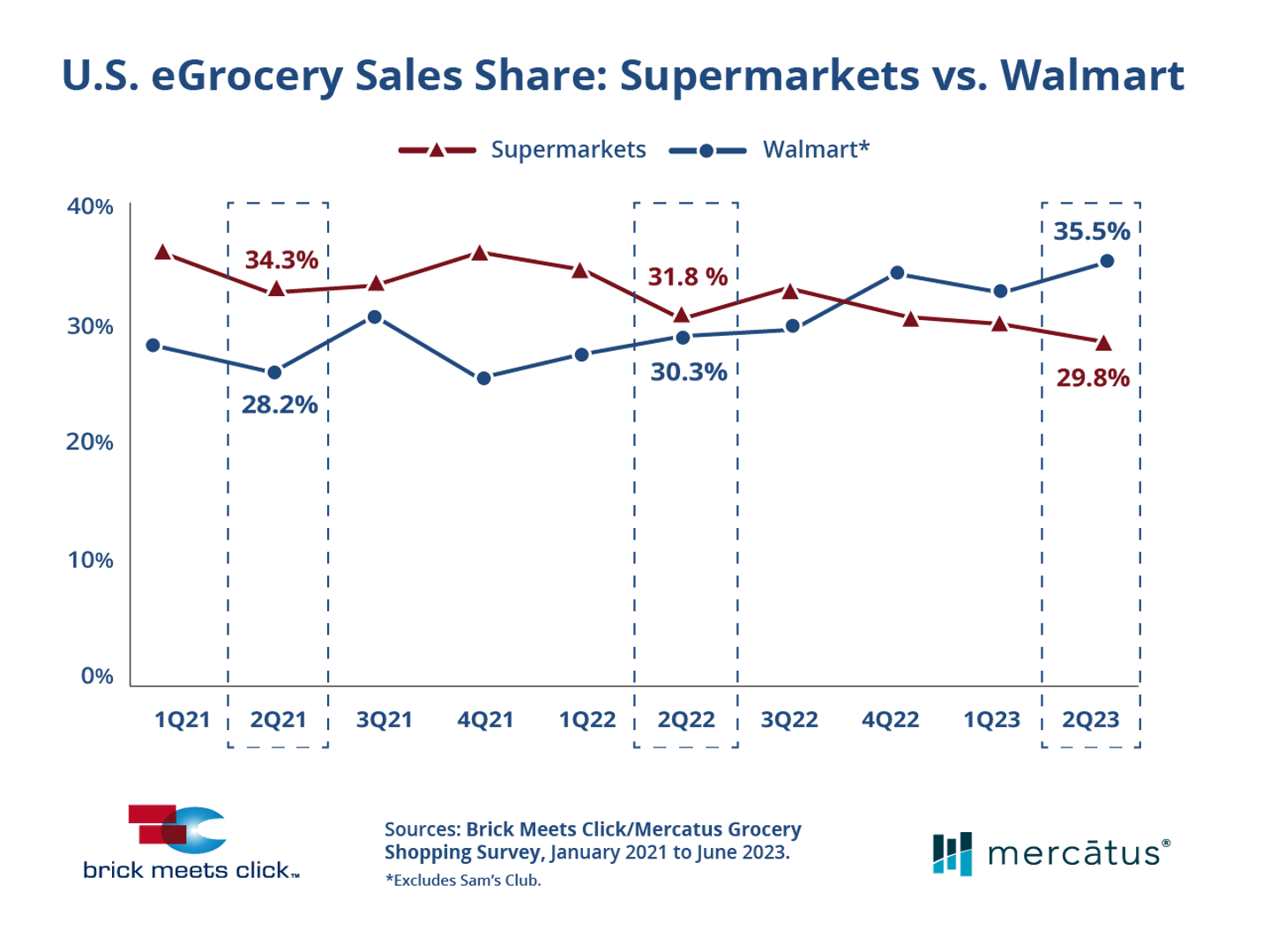

Walmart’s digital dominance is underlined in a new report from Barrington, Ill.-based research and analytics firm Brick Meets Click. According to that report, the mass retailer captured nearly 36% of all e-grocery sales in the United States during the second quarter of 2023. Moreover, Walmart’s share was 5% higher compared to last year.

On its path to e-comm success, Walmart is edging out traditional grocers. Brick Meets Click data shows that Walmart completed the second quarter with a 570-basis point share (bps) advantage over supermarkets. Contrast that to the second quarter of 2022, when traditional grocers led Walmart by 150 bps.

[Read more: “How Walmart is Making Grocery Delivery More Enticing”]

A strong performance in pickup helped drive this year’s gains and secured Walmart’s strength in the digital channel. The latest report, which was sponsored by Mercatus, showed that Walmart’s share of overall e-grocery pickup orders reached 48% during the second quarter, also an improvement over 2022.

David Bishop, partner at Brick Meets Click, said that the overall operating environment also propelled Walmart to its leading performance. “The combined effect of price inflation and the expiration of COVID financial supports has triggered a flight-to-value as purchasing power remains under pressure,” he reported.

As a result, he added, other food retailers need to emphasize their own value equation to shoppers. “This means it’s vital for grocers to offer customers more ways to save money while also providing the experience that online shoppers expect, as cost considerations will weigh more heavily than convenience for cash-strapped households in the second half of this year,” Bishop said.

Sylvain Perrier, president and CEO of Mercatus, offered additional guidance. “As competition for the shopper intensifies, regional grocers should be leveraging analytics and insights to provide customers with personalized recommendations, discounts, and offers as well as developing targeted, cost-effective strategies to encourage and reward repeat purchases online and in-store. In addition, grocers can expand the online market they serve by offering pickup as a lower-cost alternative to delivery,” he suggested.

Target is another mass merchant that is doing well in the e-grocery channel, the report indicates. Brick Meets Click found that Target held about 7% of e-grocery sales during Q2, up 70 bps on a two-year stack. The report attributed Target’s performance to its e-comm execution and pricing that is “halfway between supermarkets and Walmart.”

Even as major chains like Walmart and Target make inroads among shoppers for value and convenience, the Brick Meets Click and Mercatus data reveals that the overall e-grocery market is decelerating. Total e-grocery sales slid 1.1% during the second quarter on a year-over-year basis. Fewer orders were completed per household in that time frame.

Each week, approximately 230 million customers and members visit Walmart’s more than 10,500 stores and numerous e-commerce websites under 46 banners in 24 countries. The Bentonville, Ark.-based company employs approximately 2.3 million associates worldwide. Walmart U.S. is No. 1 on Progressive Grocer’s 2023 list of the top food and consumables retailers in North America. PG also named the company as one of its Retailers of the Century. Minneapolis-based Target Corp. is No. 6 on The PG 100, with nearly 2,000 locations, and was likewise one of PG’s Retailers of the Century.