What Do March Sales Figures Reveal About Shopper Mindsets?

March came in like a lion, and not just weather-wise, when it came to the sales environment. New data shows that it was a mixed bag for grocers, as macroeconomic pressures, including still-elevated prices and tariff-related whiplash, affected grocery shopping behaviors.

According to monthly category reports shared by 210 Analytics and using data from Chicago-based Circana, prices across all food and beverage categories tracked by Circana MULO+ rose 3.3%, including a 3.8% gain in the fresh perimeter and a 3.5% increase in center store. Wobbly consumer sentiment spurred more people to prepare foods at home, benefiting grocers over restaurant operators.

[RELATED: Are Inflation-Weary Consumers Growing Their Own Food?]

On the sales front, categories that did well last month with shoppers prioritizing at-home meals included fresh meat, up 7.5% year-over-year (YoY) in dollars, fresh fruit (+6.7% YoY ) and frozen seafood (+5.1%YoY). Other seafood segments, including canned and fresh items, saw bumps in dollar sales, units and pounds.

The late timing of Lent and Easter this year affected the seafood category as well as the baked goods category. “Reflecting the four weeks ending March 30, 2025, the impact of the mismatch in Easter led to tough comp sales for many departments,” noted Anne-Marie Roerink, principal at 210 Analytics.

Ahead of the egg-centric Easter holiday, 210 Analytics reported that fresh perimeter prices were impacted by a 72% surge in egg prices compared to March 2024. Those prices are leveling off this month, however, as avian influenza cases decline.

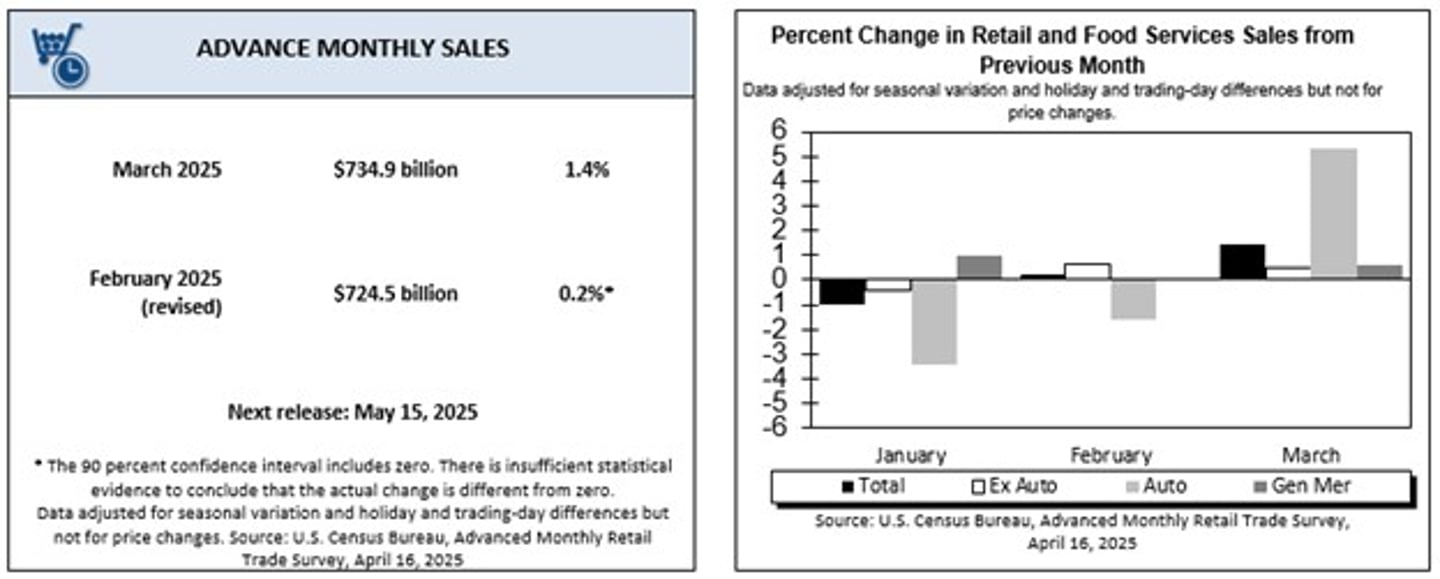

Meanwhile, some ups and downs were revealed in the latest data from the U.S. Census Bureau. According to that agency, advanced estimates of U.S. retail and foodservices report sales for March, adjusted for seasonal variation, rose 1.4% from the prior month and climbed 4.6% from 2024.

The April 16 federal government report revealed that grocery sales ticked up slightly, reaching $76.25 billion versus $76.10 billion in February. On a YoY basis, grocery sales came in 3.7% higher.

“Retail sales strengthened in March, supported by continued solid growth in income, lower energy costs and bigger-than-usual tax refunds that all helped support household budgets,” observed Jack Kleinhenz, chief economist at the National Retail Federation. “However, there is no question that the consumer is not feeling great given the confusion of policy announcements from Washington. On-again, off-again rising tariffs and resulting turmoil in the stock market and world economy are clearly impacting consumer concerns about higher prices and future consumer spending growth.”