Grocery Showdown: Why Shoppers Are Calling the Shots in 2025

Grocery shoppers are no longer quietly adapting to market conditions — they are actively reshaping the industry. From rising prices to new tech expectations, today’s consumers are taking charge of how, where, and why they shop. And the message to retailers is clear: Keep up or get left behind.

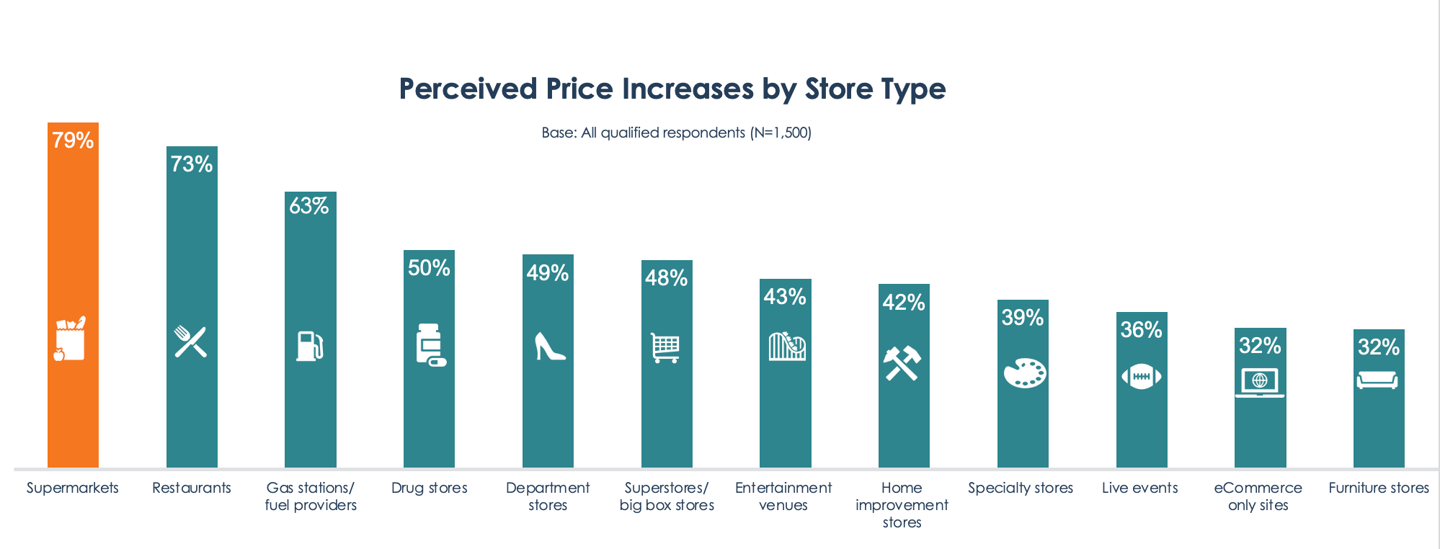

Provoke Insights’ biannual consumer trends study surveyed 1,500 Americans to better understand how grocery behaviors are evolving. The results are striking: 79% of Americans have noticed grocery prices going up. What’s more, grocery inflation is being felt more strongly than in any other retail category — including restaurants, gas stations, drug stores, and department stores [Figure 1]. Consumers aren’t just reacting, they’re also rewriting the rules, creating a new grocery reality that demands a smarter, faster and more flexible approach.

Here are four forces driving this transformation.

1. Loyalty Is No Longer Tied to Labels

As grocery prices continue to rise, consumers are abandoning brand loyalty in favor of affordability. Among shoppers who noticed price increases, nearly half say that they’re turning to private label products to cut costs. This trend is driven by widespread sensitivity to inflation, especially among Baby Boomers and Gen X, who are significantly more likely to notice price hikes.

At the same time, younger consumers are taking a proactive approach: 33% of Gen Z shoppers report buying in bulk as a key tactic to manage grocery costs. These behaviors suggest a long-term shift in how shoppers define value. Retailers that emphasize the quality and savings of their private label lines — and expand bulk options — will be best positioned to build trust and drive loyalty in this new environment.

[RELATED: What Do March Sales Figures Reveal About Shopper Mindsets?]

2. Shopping Routines Have Been Permanently Disrupted

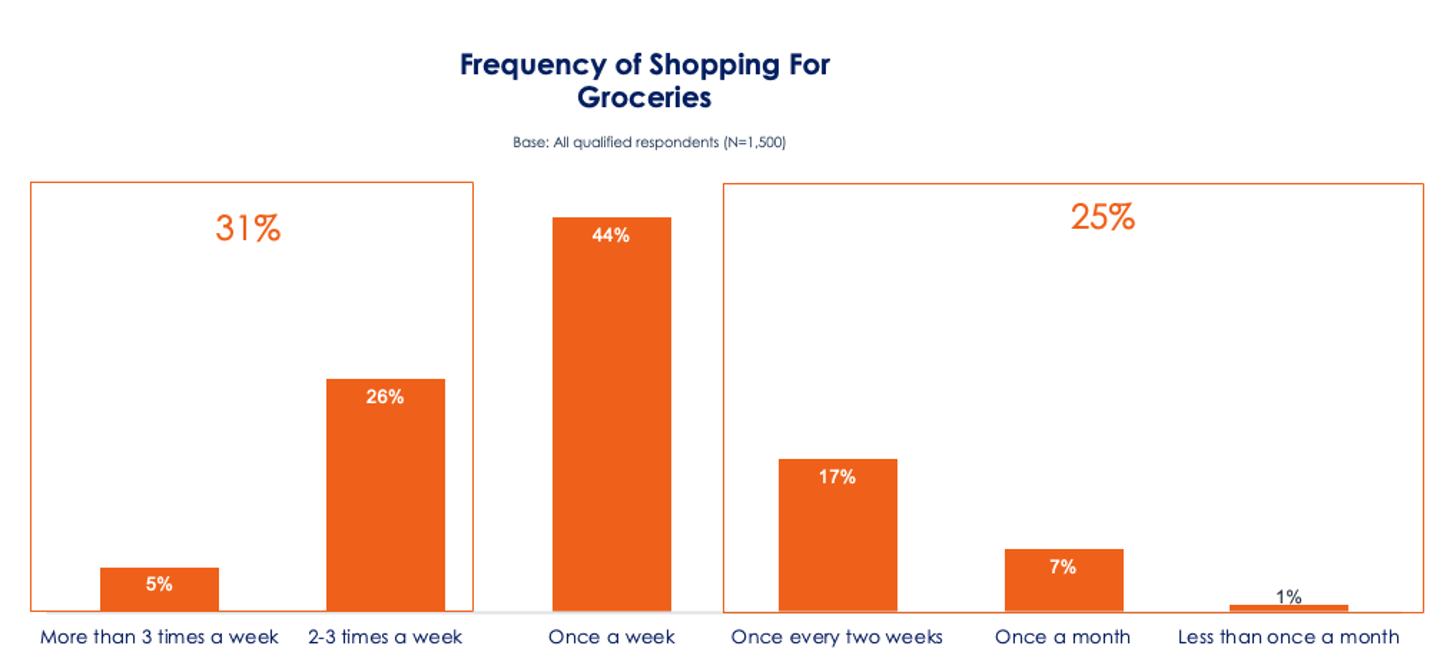

Traditional weekly shopping patterns have given way to more flexible, frequent visits. Nearly one-third (31%) of Americans now grocery shop more than once per week [Figure 2]. This trend is especially prevalent among parents (39%), Millennials (36%) and urban dwellers (38%).

Flexible work schedules — fueled by the rise of remote and hybrid work—are allowing consumers to make shorter, more spontaneous trips throughout the week. Retailers can seize this opportunity by offering rotating promotions, quick meal solutions, and loyalty programs that reward frequent visits rather than large basket sizes.

3. Digital Grocery Is Now the Baseline

Online grocery shopping has fully entered the mainstream, with almost a third of shoppers purchasing through this channel. Among online grocery shoppers, 47% of those with household incomes of more than $150,000 and 44% of urban residents say that they prefer using Amazon. In contrast, 37% of suburban shoppers say that they favor using their supermarket’s own branded website. Grocery delivery services such as Instacart are popular among Gen X (35%).

Consumers expect more than basic functionality — they want a personalized, seamless experience. Real-time inventory, smart substitutions and customized product suggestions are now baseline expectations. Retailers that invest in improving their digital platforms — not just for transactions, but also for building brand trust — will be the ones to capture and retain digital-first shoppers.

4. AI Is Influencing the Shopping Journey

Artificial intelligence is no longer a futuristic concept — it’s already shaping how consumers plan their grocery trips. Nearly 40% of Americans say that they would use AI-powered tools to optimize their grocery lists. Interest is highest among Gen Z (45%), Millennials (43%) and parents (45%), all of whom are actively seeking smarter ways to shop.

These consumers are looking for technology that not only saves time, but also adds value —such as personalized recommendations, dietary suggestions and real-time promotions. Retailers that implement intuitive, AI-driven features into apps and websites can deliver a more relevant, efficient and satisfying experience — turning innovation into shopper loyalty.

The grocery industry is at a pivotal moment. Consumers are demanding more: better value, smarter tools, and more flexible, convenient options that align with how they live today. They are not just reacting to rising prices, they’re also reshaping the expectations and behaviors that will define grocery shopping for years to come.

Retailers that evolve with these changes — those that rethink brand loyalty, reimagine shopping frequency, invest in digital performance and embrace AI — will be the ones that thrive. The rest may find themselves outpaced in a market that rewards bold, data-driven decisions and customer-centric strategies.

Methodology

Now in its 10th wave, Provoke Insights’ biannual trends study surveyed 1,500 Americans between the ages of 21 and 65 in March 2025. A 15-minute online questionnaire was conducted using a random stratified sampling methodology to ensure that the results are representative of the U.S. population. Findings have a maximum margin of sampling error of ±2.5% at a 95% confidence level.