How Are Shoppers Spending in Grocery?

Over the last few weeks, retail leaders have shared their views that consumers are reining in spending and likely to be wary for the short-term future.

Last week, for example, Dollar General CEO Todd Vasos reported in an earnings call that, “Many of our customers report that only have enough money for basic essentials, with some noting that they have had to sacrifice even on the necessities. As we enter 2025, we are not anticipating improvement in the macroenvironment, particularly for our core customer.”

Walmart CEO Doug McMillon sounded a similar note during a speech to Economic Club of Chicago last month. “There are lots of income levels in this country. If you’re at the lower end of that scale, you are feeling more frustration and pain because of higher food prices. They’ve persisted for years now, and you’re just tired of it,” he said.

[RELATED: 76th Consumer Expenditures Study: Meet the 2025 Shopper]

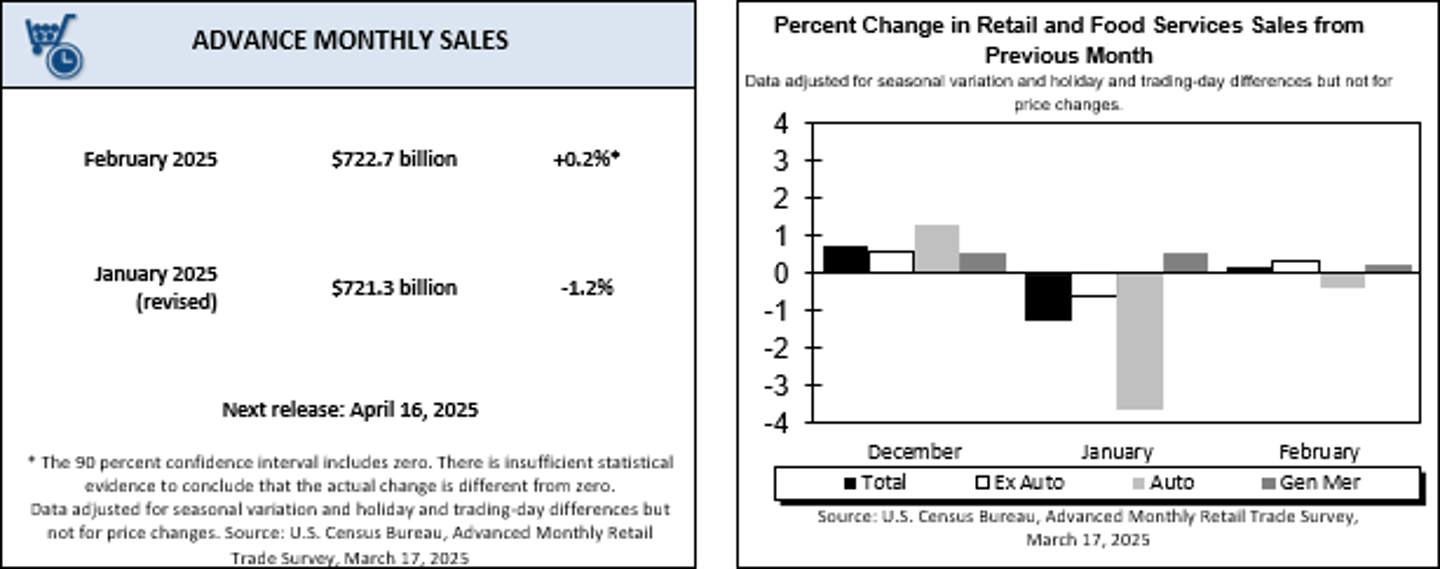

Those pragmatic assessments align with consumer behavior, even as inflation continues to moderate and, in some grocery categories, decline. The latest data from the U.S. Census Bureau shows that advance estimates of U.S. retail and foodservice sales ticked up 0.2% to $722.7 billion last month, moving higher but coming in below analyst expectations. On a year-over-year (YoY), total sales increased 3.1%.

Within grocery, estimated monthly sales topped $76.38 billion, compared to $76.07 billion in January and $73.26 billion in February 2024. The government data also points to ongoing habits of eating at home, as spending for foodservices and drinking places moved down to nearly $95.49 billion from nearly $96.98 billion in January.

Weighing in on the latest data, the chief economist at the National Retail Federation (NRF) echoed some of the retail executives’ take on a consumer base that is still spending but hanging onto their wallets. “Lower-than-expected consumer spending in the first couple of months of the year likely reflected payback for very strong spending in the fourth quarter and weather-related events since then,” remarked Jack Kleinhenz. “Moreover, these results show that households are apprehensive and carefully navigating lingering inflation and turmoil related to changing economic policies. Regardless of the softer spending, consumer fundamentals remain healthy and intact so far, supported by low unemployment, steady income growth and other household finances. American shoppers will likely continue to spend as long as unemployment remains low and job growth continues.”

Chip West, retail and consumer behavior expert at RRD, agreed that consumer spending reflects current headwinds, if not crosswinds. “I believe the mindset of many consumers is reactionary and affected by ever-changing economic and policy information. Negative news one day can evolve into positive news a few days later,” he pointed out. “The nature of the news cycle can impact sentiment and the psyche of consumers regarding their spending. Retailers should be prepared to continually align their marketing to attract value-seekers when they are in ‘savings mode,’ especially after absorbing varying economic news. Retailers also need to be ready to motivate these same consumers that are likely to splurge on a purchase, perhaps a more discretionary one, when favorable reporting has them feeling good."

E-Grocery Looking Good

E-commerce is one bright spot in this selling environment. The latest Brick Meets Click/Mercatus shopping survey found that e-grocery sales climbed 31% YoY to hit $10.3 billion, as a record 80 million U.S. households placed one or more digital grocery orders last month.

Shoppers’ quest for value played into some of the recent online behaviors. “We are a little more than a half year into e-grocery’s current growth curve, fueled by aggressive offers to lock in customers for at least 12 months,” shared David Bishop, partner at Brick Meets Click. “So far, the response from U.S. households reveals a sizable amount of latent demand that has been unlocked by offering discounts designed to help customers save more money on online grocery orders.”

Within e-grocery, delivery remained a strong fulfillment mode, growing more than 45% versus a year ago and reaching $4.5 billion in sales. Pickup grew in February, but its share of the digital market contracted slightly. As for store type, supermarket and mass retailers had a good month, per the Brick Meets Click/Mercatus researching, increasing YoY across top-line sales, monthly active users, order frequency and average order value.

“Regional grocers are converting first-time shoppers into more loyal customers as evidenced by the rising repeat intent rates, but so is Walmart,” observed Mark Fairhurst, chief growth marketing officer at Mercatus. “While deep discounts have driven a lot of trial, making a good first impression is essential to longer-term success. That means providing a more seamless shopping experience by pairing relevant personalized offers, order fulfilment, and sought-after loyalty rewards to encourage customers to shop online again.”